Use these links to rapidly review the document

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant S

Filed by a Party other than the Registrant £

Check the appropriate box:

| ||

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | ||

|

| |

ý | ||

|

| |

o | ||

|

| |

o | Soliciting Material under §240.14a-12 | |

| ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý |

| |||

WOLVERINE WORLD WIDE, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| ||||

o | |||||

|

| ||||

(1) | Title of each class of securities to which transaction applies: | ||||

| (2) | |||||

| Aggregate number of securities to which transaction applies: | ||||

| (3) | |||||

| Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||||

| (4) | |||||

| Proposed maximum aggregate value of transaction: | ||||

| (5) | |||||

| Total fee paid: | ||||

o | |||||

|

| ||||

o | |||||

|

| ||||

(1) |

|

| |||

| (2) | |||||

| Form, Schedule or Registration Statement No.: | ||||

| (3) | Filing Party: | ||||

| (4) | |||||

|

| ||||

| Date Filed: | ||||

LETTER TO STOCKHOLDERSSHAREHOLDERS

Wolverine World Wide, Inc.

9341 Courtland Drive, N.E.

Rockford, Michigan 49351

March 12, 2014

28, 2017

Dear Stockholder,Fellow Shareholders,

You are invitedI am pleased to attend the 2014invite you to join me, our Board of Directors, members of Wolverine Worldwide's senior management team, and your fellow shareholders at Wolverine Worldwide's 2017 Annual Meeting of Stockholders,Shareholders on Wednesday, April 23, 2014,Thursday, May 4, 2017, at Wolverine Worldwide’s10:00 a.m. EDT, at the Company's headquarters in Rockford, Michigan. The attachedProxy Statement andNotice of 2017 Annual Meeting of Shareholders provide you with information regarding the business to be conducted. There are a number of proposals for you to consider. Your vote is important, so please be sure to do so – whether online, by phone, or by mail with the enclosed proxy or voting instruction card.

2016 was a year of great progress for our Company, with our Board of Directors and senior management team focused on addressing the dynamic and fast-changing consumer marketplace through a prioritization on innovation and growth, omnichannel transformation, and operational excellence. We opened a new design and innovation center, reorganized our European, Canadian, Apparel and Accessories, and Direct-to-Consumer businesses, and restructured our credit facility, while delivering nearly $300 million in operating cash flow, reducing year-end inventories by 25%, and, most importantly, delivering 32.9% in total shareholder return, performance at the 91st percentile of our peer group. Our strong performance has continued into 2017, with 14.0% year-to-date total shareholder return through the March 13, 2017 record date for this year's annual meeting.

TheIn addition, since our last annual meeting, will beginthe Compensation Committee engaged a new independent executive compensation consultant, and members of our Board of Directors and senior management team redoubled efforts to speak with an introductionshareholders to better understand your perspectives on important governance and compensation matters. Of primary importance this past year, following the disappointing results of management attendeesour 2016 say-on-pay vote, was discussing our executive compensation program with shareholders and directors, followed by votingdetermining how to best demonstrate responsiveness to your concerns. We reached out to shareholders holding nearly two-thirds of our outstanding shares and held meetings, most of them in person, with more than half of these shareholders, including each shareholder who accepted our invitation. Joseph Gromek, the Chair of our Compensation Committee, led these meetings, which focused not only on our executive compensation program, but also on the matters set forthCompany's governance protocols and publicly-announced strategic initiatives. The details of this outreach effort and the changes made by the Compensation Committee in the accompanying Notice of Annual Meeting andresponse to shareholder feedback are discussed throughout this Proxy Statement and within the Compensation Discussion and Analysis, but, in summary, we:

| | |

| | |

Wolverine Worldwide Notice of 2017 Annual Meeting of Shareholders and Proxy Statement | | | Page 1 |

We greatly value the conversation we have had with our shareholders. We appreciate that this is an ongoing dialogue and look forward to continuing the conversation before, at, and after our 2017 Annual Meeting.

Sincerely,

![]()

David T. Kollat

Lead Independent Director

| | |

| | |

Page 2 | | | Wolverine Worldwide Notice of 2017 Annual Meeting of Shareholders and Proxy Statement |

NOTICE OF 2017 ANNUAL MEETING OF SHAREHOLDERS

Wolverine World Wide, Inc.

9341 Courtland Drive, N.E.

Rockford, Michigan 49351

March 28, 2017

To our Shareholders:

We invite you to attend Wolverine Worldwide's Annual Meeting of Shareholders at the Company's headquarters located at 9341 Courtland Drive, N.E., Rockford, Michigan 49351, on Thursday, May 4, 2017, at 10:00 a.m. EDT. At the annual meeting, the shareholders will vote on the following items:

Shareholders of record as of March 13, 2017 can vote at the meeting and any other business matters properly brought beforeadjournment of the meeting. The meeting will adjourn

This Notice of 2017 Annual Meeting of Shareholders, Proxy Statement, proxy or voting instruction card and Annual Report for a presentationour fiscal year ended December 31, 2016 are being mailed or made available to shareholders starting on the Company’s business operations, and then resume for a report on the voting.

or about March 28, 2017.

Whether or not you plan to attend, you can ensure that your shares are represented at the meeting by promptly voting and submitting your proxy by telephone or through the Internet,internet, or by completing, signing, dating and returning your proxy formcard in the enclosed envelope.

Sincerely,

![]()

Blake W. Krueger

Chairman

|

NOTICE OF 2014 ANNUAL MEETING OF STOCKHOLDERS

10:00 a.m., April 23, 2014

Wolverine World Wide, Inc.

9341 Courtland Drive, N.E.

Rockford, Michigan 49351

March 12, 2014

To our Stockholders:

We invite you to attend Wolverine Worldwide’s Annual Meeting of Stockholders at the Company’s headquarters located at 9341 Courtland Drive, N.E., Rockford, Michigan, on Wednesday, April 23, 2014, at 10:00 a.m. Eastern Daylight Time. The annual meeting will begin with an introduction of management attendees and directors, after which stockholders will:

(1)vote on the election of the four director nominees named in the proxy statement for three-year terms expiring in 2017;

(2)vote on an amendment to the Certificate of Incorporation to increase the number of authorized shares of Common Stock;

(3)vote on the ratification of the Audit Committee’s appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal year 2014;

(4)vote on an advisory resolution approving compensation for the Company’s named executive officers; and

(5)transact other business that may properly come before the meeting.

The meeting will adjourn for a presentation on the Company’s business operations, then resume for a report on the voting results. You can vote at the meeting and any adjournment of the meeting if you were a stockholder of record on March 3, 2014.

By Order of the Board of Directors

![]()

Brendan M. Gibbons

Senior Vice President, General Counsel and Secretary

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on May 4, 2017.

![]()

Timothy E. Foley

Assistant Secretary

|

| |

| | |

|

Wolverine Worldwide Notice of | | | Page 3 |

2014 PROXY STATEMENT

|

Table of ContentsMEETING INFORMATION

We areWolverine World Wide, Inc. ("Wolverine Worldwide" or the "Company") is furnishing you this proxy statement and enclosed proxy card in connection with the solicitation of proxies by theits Board of Directors of Wolverine World Wide, Inc. (“Wolverine Worldwide” or the “Company”) to be used at the Annual Meeting of StockholdersShareholders of the Company.Company occurring on May 4, 2017 at the Company's corporate headquarters in Rockford, Michigan (the "Annual Meeting"). Distribution of this proxy statement and enclosed proxy card to stockholdersshareholders is scheduled to begin on or about March 12, 2014.

28, 2017.

You can ensure that your shares are voted at the meetingAnnual Meeting by submitting your instructions by telephone or through the Internet, or by completing, signing, dating, and returning your proxy form in the enclosed envelope. Submitting your instructions or proxy by any of these methods will not affect your right to attend and vote at the meeting. We encourage stockholdersAnnual Meeting. The Company encourages shareholders to submit proxies in advance. A stockholdershareholder who gives a proxy may revoke it at any time before it is exercised by voting in person at the annual meeting,Annual Meeting, by delivering a subsequent proxy, or by notifying the inspectors of election in writing of such revocation. In order to vote any shares at the meetingAnnual Meeting that are held for you in a brokerage, bank, or other institutional account, you must obtain a proxy from that entity and bring it with you to hand in with your ballot.

References to “2013”"2016" or “fiscal year 2013”"fiscal 2016" in this proxy statement are to the Company’sCompany's fiscal year endingended December 28, 2013,31, 2016, unless otherwise noted in the text. References to “2014”"2017" or “fiscal year 2014”"fiscal 2017" in this proxy statement are to the Company’sCompany's fiscal year ending January 3, 2015,December 30, 2017, unless otherwise noted in the text.

| | |

| | |

Page 4 | | | Wolverine Worldwide Notice of 2017 Annual Meeting of Shareholders and Proxy Statement |

2017 PROXY STATEMENT

Table of Contents |

Letter to Shareholders | 1 | |

Notice of 2017 Annual Meeting of Shareholders | 3 | |

Meeting Information | 4 | |

Proxy Statement Summary | 7 | |

Summary of Shareholder Voting Matters | 7 | |

Proposal 1 – Election of Directors for Terms Expiring in 2020 | 7 | |

Board Highlights | 8 | |

Board is Composed of Directors with the Right Mix of Skills and Experiences | 8 | |

Corporate Governance Highlights | 9 | |

Proposal 2 – Advisory Vote to Approve NEO Compensation | 10 | |

Our Brand Portfolio | 10 | |

Strategic Focus | 10 | |

Key 2016 Accomplishments and Financial Highlights | 11 | |

Shareholder Engagement | 11 | |

Compensation Philosophy – Pay at Risk | 12 | |

Compensation Best Practices | 13 | |

Corporate Governance | 14 | |

Board of Directors | 14 | |

Board Composition | 14 | |

Director Nominations | 15 | |

Board Self-Assessment | 16 | |

Risk Oversight | 16 | |

Code of Business Conduct and Accounting and Finance Code of Ethics | 17 | |

Shareholder Communications Policy | 17 | |

Proposal 1 – Election of Directors for Terms Expiring in 2020 | 18 | |

Directors with Terms Expiring in 2020 | 19 | |

Directors with Terms Expiring in 2018 | 23 | |

Directors with Terms Expiring in 2019 | 26 | |

Board Leadership | 30 | |

Director Independence | 30 | |

Board Committees, Meetings and Meeting Attendance | 31 | |

Audit Committee | 31 | |

Compensation Committee | 32 | |

Governance Committee | 32 | |

Non-Employee Director Compensation in Fiscal Year 2016 | 33 | |

Non-Employee Director Stock Ownership Guidelines | 35 | |

Securities Ownership of Officers and Directors and Certain Beneficial Owners | 36 | |

Five Percent Shareholders | 36 | |

Stock Ownership by Management and Others | 37 | |

A Letter From Our Compensation Committee | 38 | |

Compensation Discussion and Analysis | 39 | |

Summary | 39 | |

Compensation Philosophy and Objectives | 39 | |

Shareholder Outreach | 39 | |

Strategic Priorities | 41 | |

Compensation Decisions in Context: Key 2016 Accomplishments and Financial Highlights | 42 | |

Compensation Overview | 42 | |

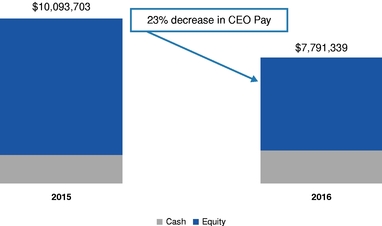

Year-Over-Year Change in CEO Pay | 43 | |

CEO Annual Bonus/TSR Analysis | 44 | |

2016 Compensation Program Overview | 45 | |

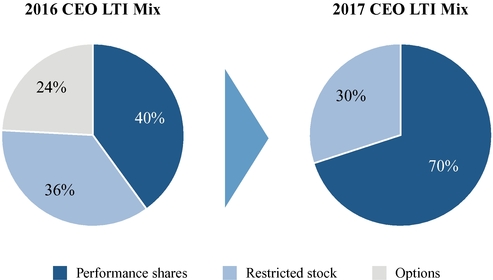

Long-Term Incentive Program Mix | 45 | |

Pay at Risk | 46 | |

Compensation Best Practices | 46 | |

Compensation Discussion and Analysis in Detail | 47 | |

2016 Compensation Program Overview | 47 | |

Setting Targets | 47 | |

Base Salary | 47 | |

Annual Bonus | 48 | |

Performance Bonus | 48 | |

Individual Performance Bonus | 49 | |

2017 Annual Bonus Plan Update | 51 | |

Long-Term Incentive Compensation | 52 | |

Performance Shares | 52 | |

2016 Performance Share Awards | 53 | |

Stock Option Grants and Restricted Stock Awards | 54 | |

2017 Long-Term Incentive Plan Update | 54 | |

Benefits | 54 | |

Retirement, Deferred Compensation and Welfare Plans | 54 | |

Perquisites | 55 | |

Post-Employment Compensation | 55 | |

Compensation Setting Process | 56 | |

Setting Targets | 56 | |

Competitive Philosophy and Competitive Market Data | 56 | |

Peer Group | 56 | |

New 2017 Peer Group | 57 | |

CEO Role | 57 | |

Compensation Consultant Role | 57 | |

Other Compensation Policies and Practices | 58 | |

NEO Stock Ownership Guidelines | 58 | |

Stock Hedging and Pledging Policies | 58 | |

Clawback Policy | 58 | |

Impact of Accounting and Tax Treatments on Compensation | 58 | |

Compensation Committee Report | 59 | |

Summary Compensation Table | 60 | |

Grants of Plan-Based Awards in Fiscal Year 2016 | 62 | |

Outstanding Equity Awards at 2016 Fiscal Year-End | 64 | |

Option Exercises and Stock Vested in Fiscal Year 2016 | 68 | |

| | |

| | |

Wolverine Worldwide Notice of 2017 Annual Meeting of Shareholders and Proxy Statement | | | Page 5 |

2017 PROXY STATEMENT

Pension Plans and 2016 Pension Benefits | 69 | |

Qualified Pension Plan | 69 | |

Supplemental Executive Retirement Plan | 69 | |

Pension Benefits in Fiscal Year 2016 | 70 | |

Nonqualified Deferred Compensation | 71 | |

Nonqualified Deferred Compensation | 71 | |

Potential Payments Upon Termination or Change in Control | 72 | |

Benefits Triggered by Termination for Cause or Voluntary Termination | 72 | |

Benefits Triggered by Termination Other Than for Cause or for Good Reason | 72 | |

Benefits Triggered Upon a Change in Control | 73 | |

Benefits Triggered by Retirement, Death or Permanent Disability | 74 | |

Description of Restrictive Covenants that Apply During and After Termination of Employment | 75 | |

Estimated Payments on Termination or Change in Control | 75 | |

Proposal 2 – Advisory Resolution To Approve Executive Compensation | 78 | |

Proposal 3 – Advisory Vote on the Frequency of Future Advisory Votes on Executive Compensation | 79 | |

Proposal 4 – Ratification of Appointment of Independent Registered Public Accounting Firm | 80 | |

Audit Committee Report | 81 | |

Independent Registered Public Accounting Firm | 83 | |

Proposal 5 – Approval of Amended and Restated Executive Short-Term Incentive Plan (Annual Bonus Plan) | 84 | |

Overview | 84 | |

Purpose of the Plan | 84 | |

Summary of the Plan | 85 | |

Amendment and Termination | 87 | |

Vote Required and Board Recommendation | 87 | |

Related Party Matters | 88 | |

Certain Relationships and Related Transactions | 88 | |

Related Person Transactions Policy | 88 | |

Additional Information | 89 | |

Shareholders List | 89 | |

Director and Officer Indemnification | 89 | |

Section 16(a) Beneficial Ownership Reporting Compliance | 89 | |

Shareholder Proposals for Inclusion in Next Year's Proxy Statement | 89 | |

Other Shareholder Proposals for Presentation at Next Year's Annual Meeting | 89 | |

Voting Securities | 90 | |

Conduct of Business | 90 | |

Vote Required for Election and Approval | 90 | |

Voting Results of the Annual Meeting | 91 | |

Attending the Annual Meeting | 91 | |

Manner for Voting Proxies | 91 | |

Revocation of Proxies | 91 | |

Solicitation of Proxies | 91 | |

Delivery of Documents to Shareholders Sharing an Address | 91 | |

Access to Proxy Statement and Annual Report | 92 | |

Appendix A – Amended any Restated Executive Short Term Incentive Plan (Annual Bonus Plan) | A-1 | |

Appendix B – Forward-Looking Statements and Non-GAAP Reconciliation Table | B-1 |

| | |

| | |

Page 6 | | | Wolverine Worldwide Notice of 2017 Annual Meeting of Shareholders and Proxy Statement |

This summary highlights key information that can be found in greater detail elsewhere in this Proxy Statement. This summary does not contain all of the information that shareholders should consider, and shareholders should read the entire Proxy Statement before voting.

SUMMARY OF SHAREHOLDER VOTING MATTERS

Shareholders are being asked to vote on the following matters at the 2017 Annual Meeting of Shareholders:

| | | | | | | | | | | |

| PROPOSAL | BOARD VOTE RECOMMENDATION | PAGE REFERENCE | ||||||||

| | | | | | | | | | | |

| 1. | Election of Directors for Terms Expiring in 2020 | FOR each Nominee | 18 | |||||||

| | | | | | | | | | | |

| 2. | Advisory Resolution Approving NEO Compensation | FOR | 78 | |||||||

| | | | | | | | | | | |

| 3. | Frequency of Future Advisory Votes on Executive Officers Compensation to be Every Year | EVERY ONE YEAR | 79 | |||||||

| | | | | | | | | | | |

| 4. | Ratification of Ernst & Young LLP as Auditor for Fiscal Year 2017 | FOR | 80 | |||||||

| | | | | | | | | | | |

| 5. | Approval of the Amended & Restated Executive Short-Term Incentive Plan (Annual Bonus Plan) | FOR | 87 | |||||||

| | | | | | | | | | | |

PROPOSAL 1 – ELECTION OF DIRECTORS FOR TERMS EXPIRING IN 2020

The stockholdersCompany's Board consists of 11 directors. The Company's By-Laws establish three classes of directors, with each class being as nearly equal in number as possible and serving three-year terms.

The Board has nominated four directors for election at the Annual Meeting, as outlined in the table below. Each director has been nominated to serve for a three-year term expiring at the annual meeting of shareholders to be held in 2020.The Board recommends that shareholders vote "FOR" each of the nominees named below.

| | | | | | | | | | | | | | | | | |

| Age | Director Since | Independent | Other Public Directorships | Committees | Proposed Term Expiration | |||||||||||

| | | | | | | | | | | | | | | | | |

| William K. Gerber Managing Director, Cabrillo Point Capital | 63 | 2008 | ✓ | AK Steel Holding Corporation | Audit (Chair) Compensation | 2020 | ||||||||||

| | | | | | | | | | | | | | | | | |

| Blake W. Krueger Chairman, CEO & President of Wolverine World Wide, Inc. | 63 | 2006 | None | None | 2020 | |||||||||||

| | | | | | | | | | | | | | | | | |

| Nicholas T. Long Retired CEO of MillerCoors LLC | 58 | 2011 | ✓ | None | Compensation Governance | 2020 | ||||||||||

| | | | | | | | | | | | | | | | | |

| Michael A. Volkema Chairman of Herman Miller, Inc. | 61 | 2005 | ✓ | Herman Miller, Inc. | Audit Governance (Chair) | 2020 | ||||||||||

| | | | | | | | | | | | | | | | | |

| | |

| | |

Wolverine Worldwide Notice of 2017 Annual Meeting of Shareholders and Proxy Statement | | | Page 7 |

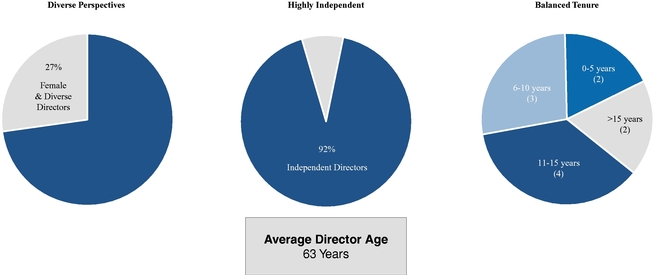

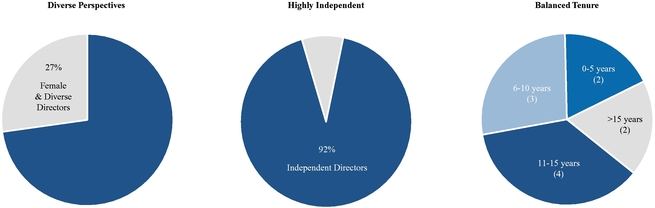

The following pie charts illustrate key characteristics of the Company's Board:

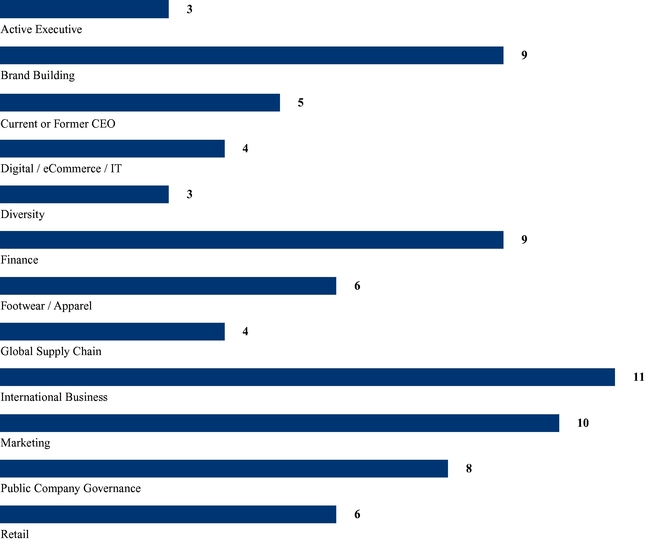

Board is Composed of Directors with the Right Mix of Skills and Experiences

The following chart lists the important experiences and attributes that the Company's Directors possess:

| | |

| | |

Wolverine Worldwide Notice of 2017 Annual Meeting of Shareholders and Proxy Statement | | | Page 8 |

Corporate Governance Highlights

Wolverine Worldwide is committed to a governance structure that provides strong shareholder rights and meaningful accountability:

| | | | | | | |

✓ Highly independent Board (All Non-Management Directors) and Committees ✓ Lead Independent Director with clearly defined role ✓ Majority voting with director resignation policy ✓ No supermajority vote requirements ✓ Shareholder right to act by written consent | ✓ Annual Board and Committee self-evaluations ✓ Robust Board and executive succession planning, including annual written director nominee evaluations ✓ Long-standing commitment toward diversity ✓ Director onboarding orientation program ✓ Active shareholder engagement practices | |||||

| | | | | | | |

| | |

| | |

Wolverine Worldwide Notice of 2017 Annual Meeting of Shareholders and Proxy Statement | | | Page 9 |

PROPOSAL 2 – ADVISORY VOTE TO APPROVE NEO COMPENSATION

For a more detailed discussion of compensation matters, please reference the CD&A beginning on page 39. While the outcome of this proposal is non-binding, the Board and Compensation Committee will consider the outcome of the vote when making future compensation decisions.The Board recommends that shareholders vote "FOR" the advisory vote to approve named executive officer compensation.

Wolverine Worldwide has a portfolio of brands organized into four key operating groups as illustrated below:

In 2016, the Company launched the WOLVERINE WAY FORWARD, an enterprise-wide initiative to transform the Company in light of the fast-changing retail environment. The WOLVERINE WAY FORWARD includes the following key components:

| | | | | | | | | | | | | | | | | |

| | Innovation & Growth | | Operational Excellence | | Portfolio Management | | People & Teams | | ||||||||

| | | | | | | | | | | | | | | | | |

• Building great brands through product innovation and compelling marketing • Relentless focus on the consumer • Consumer-centric product innovation • Demand creation initiatives • Deep focus on digital connection, specifically eCommerce and social media • International expansion | • Healthier supply chain, with improved speed to market • Omnichannel transformation focused on aggressively growing highly profitable eCommerce business and right-sizing underperforming store fleet • Faster, more efficient structure • Aggressive goal to achieve 12% adjusted operating margin by the end of 2018 | • Focus on core, go-forward brands that provide the biggest growth and profit opportunities • Identify strategic alternatives for non-core, underperforming businesses • Strategic, value-creating acquisitions | • Amazing place to work • Build the best team and talent pipeline • Modern skillset • Investment in enhanced learning and development initiatives | |||||||||||||

| | | | | | | | | | | | | | | | | |

| | |

| | |

Wolverine Worldwide Notice of 2017 Annual Meeting of Shareholders and Proxy Statement | | | Page 10 |

Key 2016 Accomplishments and Financial Highlights

Key 2016 financial highlights and accomplishments against the Company's strategic priorities are below.

| Financial Highlights | Business Accomplishments | |

• Delivered 32.9% total shareholder return for 2016, performance in the top decile of companies in its peer group • Generated operating cash flow for the year of $296.3 million, up $80.8 million or 37.5% versus the prior year • Reduced year-end inventory by 25% against a corporate objective to reduce overall inventory by 12% • Delivered revenue of $2.495 billion, in line with original guidance • Delivered reported diluted 2016 EPS of $0.89, compared to $1.20 in 2015; adjusted diluted EPS of $1.36; and, on a constant currency basis, $1.52 compared to $1.45 in 2015 • Returned value to shareholders through $0.24 per share cash dividends and approximately $62 million in share repurchases | • Progressed in our omnichannel transformation – closing 101 stores in 2016 while investing in eCommerce; additional 110 store closures anticipated for early 2017 • Refinanced debt, expecting to result in $30 million of interest savings through 2020 • Reorganized European, Canadian, Apparel and Accessories, and Direct-to-Consumer businesses • Opened new design and innovation center • Drove considerable efficiencies through supply chain improvements, including consolidation of factory base |

The Company's Board and management team were disappointed with the results of the 2016 say-on-pay vote, which failed to receive majority shareholder support. In response, the Compensation Committee and full Board undertook a thorough review of the Company's compensation program in order to determine how best to respond to shareholders. Since the 2016 annual meeting, the Company's Compensation Committee Chair has reached out to shareholders representing nearly two-thirds of its outstanding shares and has held meetings with more than half of these shareholders, mostly in person. The Company met with every shareholder who accepted its invitation to engage, and the Company's Compensation Committee Chairman, Joseph Gromek, led each of the meetings. After aggregating all shareholder feedback and sharing it with the full Board, the Compensation Committee made significant changes to the executive compensation program. The feedback received and the changes made in response are discussed in greater detail in the CD&A Summary beginning on page 39. Some highlights are summarized below:

| What we heard: | What we did: | |

| | | |

• A desire to further strengthen the link between Company performance and NEO compensation | • Reallocated LTI pay mix to be more heavily weighted towards performance units – 2017 CEO mix is 70% performance stock units and 30% time-vested restricted stock units • Paid 0% on the CEO's "individual performance bonus," resulting in an overall 2016 annual bonus payout of 58% of target • Reduced 2017 CEO long-term incentive equity grants by $500,000 compared to 2016 | |

| | | |

• An appreciation for the Company's publicly announced aggressive operating margin goal and a desire for NEO compensation to be tied to it | • Incorporated an adjusted operating margin performance modifier into the 2017 annual bonus plan to link NEO compensation to the execution of Company goals | |

| | | |

• Our use of multiple, separate financial metrics (revenue, pretax income, EPS, and BVA) could be complimented with a relative performance metric | • Added a TSR performance modifier (vs. Russell 3000 Consumer Discretionary Index) to the 2017-2019 performance share unit program | |

| | | |

• An observation that select companies in our peer group had grown too large to serve as adequate comparators | • Adopted a new peer group, removing companies that had grown too large and adding other companies to provide greater revenue alignment with the peer group median | |

| | | |

• An opportunity to improve certain governance practices | • Implemented "double-trigger" equity vesting for 2017 grants • Engaged a new independent compensation consultant in 2016 |

| | |

| | |

Wolverine Worldwide Notice of 2017 Annual Meeting of Shareholders and Proxy Statement | | | Page 11 |

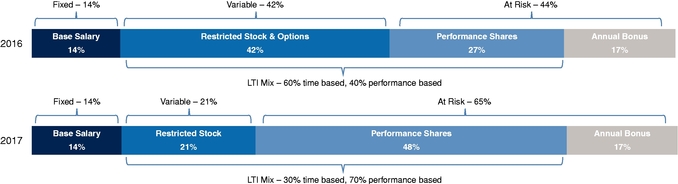

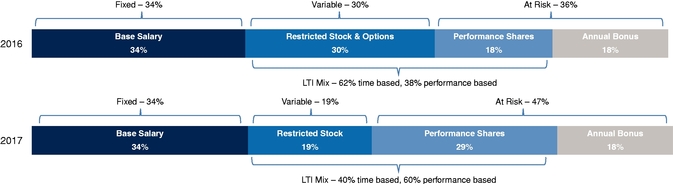

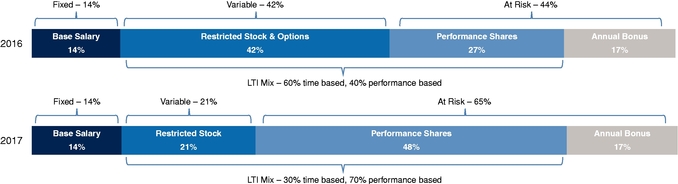

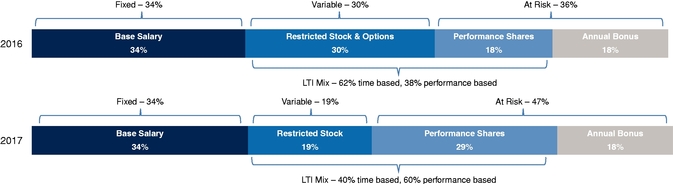

Compensation Philosophy – Pay at Risk

The Company's compensation philosophy is to align the interests of NEOs and shareholders by placing a significant portion of the compensation awarded to its NEOs generally, and the CEO in particular, at-risk (performance shares and annual bonus) and variable (restricted stock and, prior to 2017, stock options). The Compensation Committee believes this incentivizes superior business, stock price and financial performance and aligns the interests of executives with those of shareholders.

The below graphic illustrates the percentage of at-risk and variable target compensation for the CEO and the average of the other NEOs:

CEO 2016 vs. 2017 Target Total Compensation

Note: 2017 CEO equity grants were reduced by $500,000 compared to 2016 to respond to shareholders concerns regarding our 2016 say-on-pay vote. This one-time reduction is not reflected in the graphic above.

Other NEO 2016 vs. 2017 Target Total Compensation (Average)

| | |

| | |

Wolverine Worldwide Notice of 2017 Annual Meeting of Shareholders and Proxy Statement | | | Page 12 |

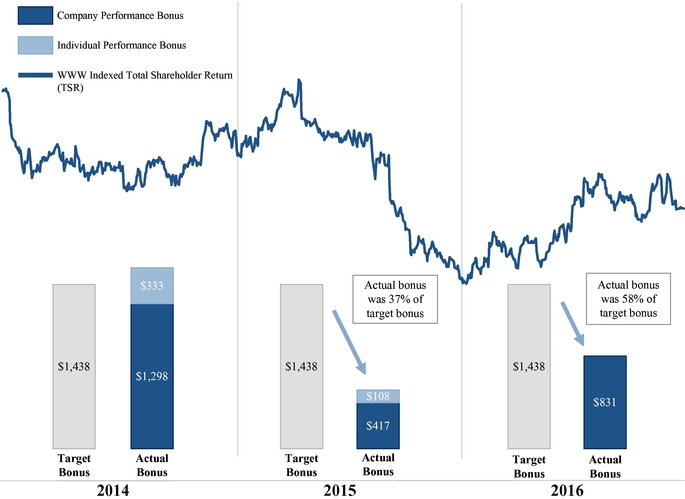

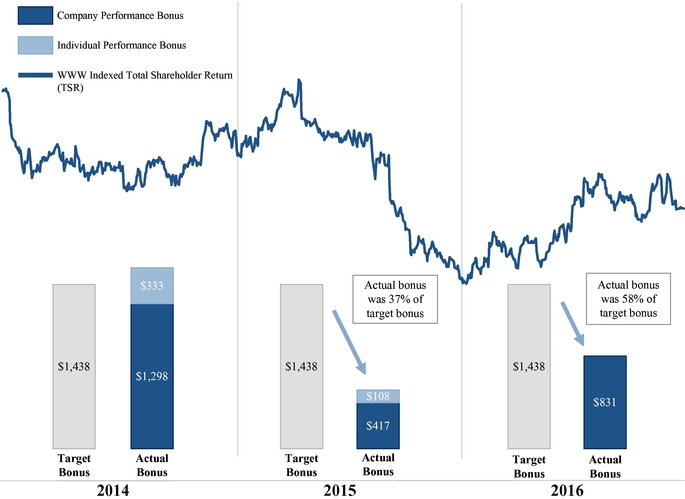

The below graphic illustrates the CEO's actual annual performance bonus compared to his target opportunity over the last three years and demonstrates the Company's pay-for-performance compensation philosophy in action – there is a clear link between Company TSR performance and annual bonus achievement over these periods. The CEO's target annual bonus opportunity has not increased over the past three years and was not increased in 2017.

CEO 3-Year Target & Actual Bonus

(in $000s)

| What we do | What we do not do | |

✓ Vast majority of pay is at-risk or variable, i.e., performance-based or equity-based or both ✓ Stringent share ownership requirements (6x base salary for CEO) ✓ Broad-based clawback policy ✓ Significant vesting horizon for equity grants ✓ Double-trigger equity acceleration (for grants in 2017 and beyond) | ✗ No dividends or dividend equivalents on unearned performance shares/units ✗ No repricing or replacing of underwater stock options ✗ No overlapping metrics ✗ No excessive or unnecessary perquisites ✗ No hedging, pledging, or short sales of Company stock |

| | |

| | |

Wolverine Worldwide Notice of 2017 Annual Meeting of Shareholders and Proxy Statement | | | Page 13 |

2017 PROXY STATEMENT

Corporate Governance |

Wolverine Worldwide is committed to the highest level of corporate governance, and the Board has adopted its Corporate Governance Guidelines to strengthen management accountability and promote long-term shareholder interests. These governance practices include:

✓ Highly independent Board (All Non-Management Directors) and Committees ✓ Lead Independent Director with clearly defined role ✓ Majority voting with director resignation policy ✓ No supermajority vote requirements ✓ Shareholder right to act by written consent | ✓ Annual Board and Committee self-evaluations ✓ Robust Board and executive succession planning, including annual written director nominee evaluations ✓ Long-standing commitment toward diversity ✓ Director onboarding orientation program ✓ Active shareholder engagement practices |

The shareholders elect the directors whoto serve on the Company's Board of Directors (the “Board”"Board of Directors" or “Board of Directors”"Board") to oversee Company management.. The Board delegates authority tooversees the management of the business by the Chief Executive Officer (“CEO”("CEO") and senior management to pursue the Company’s mission and oversees the CEO’s and senior management’s conduct of the Company’s business.management. In addition to its general oversight function, the Board reviews and assesses the Company’s strategic and business planning and senior management’s approach to addressing significant risks, and hasBoard's additional responsibilities including,include, but are not limited to, the following:

»

» reviewing the Company’s financial objectives and major corporate plans, business strategies and actions;

» providing

management»

»assessing whether adequate monitoring administration of the policies and procedures are in place to safeguard the integrity of the Company’sCompany's business operations and financial reporting and to promote compliance with applicable laws and regulations and monitoring management’s administration of those policies and procedures.

The Company expects directors to attend every meetingfollowing charts illustrate Key Board characteristics:

| | |

| | |

Page 14 | | | Wolverine Worldwide Notice of 2017 Annual Meeting of Shareholders and Proxy Statement |

BOARD COMPOSITIONContents

2017 PROXY STATEMENT

The Board prides itself on its ability to recruit and retain directors who have the highesthigh personal and professional integrity and have demonstrated exceptional ability and judgment andto effectively serve the stockholders’shareholders' long-term interests. Wolverine Worldwide seeksThe Board believes that its directors, including the nominees for election as directors at the Annual Meeting, have these characteristics and valuable skills that provide the Company with the variety and depth of knowledge, judgment and strategic vision necessary to achieve diversityprovide effective oversight of the Company.

To help accomplish this, and to assist in succession planning, the Board, at the recommendation of the Governance Committee, has identified specified skills and attributes it desires its Board membership by assembling a Board that has a broad rangemembers to possess. The below graphic lists these skills and attributes and indicates which of the directors possess each. As shown, these skills expertise, knowledge and contacts to benefitattributes are well represented within the Board.

|

| |||||||||||||||||||||||||||

| SKILLS & ATTRIBUTES | ||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Totals | Krueger | Kollat | Boromisa | Boswell | Divol | Gerber | Gromek | Lauderback | Long | O'Donovan | Volkema | ||||||||||||||||

| | | | | | | | | | | | | | ||||||||||||||||

| Active Executive | 3 | ✓ | | | ✓ | ✓ | | | | | | | | |||||||||||||||

| Brand Building | 9 | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||

| Current or Former CEO | 5 | ✓ | | | | | | ✓ | | ✓ | ✓ | ✓ | | |||||||||||||||

| Digital/eComm/IT | 4 | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||

| Diversity | 3 | | | | ✓ | ✓ | | | ✓ | | | | | |||||||||||||||

| Finance | 9 | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||

| Footwear/Apparel | 6 | ✓ | ✓ | | | | ✓ | ✓ | ✓ | | ✓ | | | |||||||||||||||

| Global Supply Chain | 4 | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||

| International Business | 11 | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | | |||||||||||||||

| Marketing | 10 | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||

| Public Company Governance | 8 | ✓ | ✓ | | | | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | | |||||||||||||||

| Retail | 6 | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||

2014 PROXY STATEMENT

the Company’s business. This goal is incorporatedBoard members in the Company’s Corporate Governance Guidelines.context of the current make-up of the Board. The Board, with the assistance of the Governance Committee, annually assesses the current composition of the Board considering diversity across many dimensions. As set forth in the Company's Corporate Governance Guidelines, which are posted on its website, this assessment addresses the above-referred skills and attributes and the individual performance, experience, age and skills of each director.

The Board andBoard's Governance Committee use this assessment when defining the criteria for a director search.

The Board’s Governance Committee actsserves as its nominating committee. The Governance Committee, in anticipation of upcoming director elections and other potential or expected Board vacancies, searches forevaluates qualified individuals and recommends candidates for director openings to the full Board. At the Company’s expense, theThe Governance Committee may retain a search firm or other external parties to assist it in identifying candidates. The Committee delegates day-to-day management and oversight of the external parties to the CEOcandidates, and the Company’s Human Resources leadership. Governance Committee has the sole authority to approve the search firm's fees and retention terms, and to terminate the firm if necessary.

The Governance Committee considers candidates suggested by directors, senior management and stockholders, and evaluates all candidates in the same manner. Stockholdersor shareholders. Shareholders may recommend individuals as potential director candidates by communicating with the Governance Committee through one of the Board communication mechanisms described under the heading “Stockholder"Shareholder Communications Policy.” Stockholders" Shareholders that wish to nominate a director candidate must comply with the procedures set forth in the by-lawsCompany's By-Laws, which are posted on the Company’sits website. Ultimately, upon the recommendation of the Governance Committee, the Board selects the Companydirector nominees for election at each annual meeting.

As stated in the Company’s Corporate Governance Guidelines, Wolverine Worldwide seeks to achieve diversity in its Board membership by assembling a group of directors who have a broad range of skills, expertise, knowledge and contacts to benefit the Company’s business. The Governance Committee and In selecting director nominees, the Board annually assessconsiders candidates' performance as a director (which is assessed through an anonymous written peer evaluation), personal and professional integrity, ability and judgment, and likelihood to be effective, in conjunction with the current make-upother nominees and directors, in serving the long-term interests of the Board, considering diversity across many dimensions, and the Committee uses this assessment when defining the criteria for a director search. The Committee, along with the Board, assesses the effectiveness of the diversity objective when reviewing the Board composition. Among other things, the Board has determined that it is important to have individuals with one or a combination of the following skills and experiences on the Board:

»FOOTWEAR, APPAREL AND RETAIL EXPERIENCE. The Company’s business focuses on the global marketing and sale of footwear and apparel, both in wholesale and retail markets. The Company has identified expanding its apparel and retail businesses as two important growth initiatives. The Board believes it is important to have directors with experience in the footwear, apparel and retail industries to provide insights into these and other areas that are critical to the Company’s success.

»LEADERSHIP EXPERIENCE. The Board believes that directors with significant leadership experience, including Chief Executive Officer experience, provide it with special insights, including organization development and leadership practices, and individuals with this experience help the Company identify and develop its own leadership talent. They demonstrate a practical understanding of organizations, process, strategy, risk management and the methods to drive change and growth. These individuals also provide the Company with a valuable network of contacts and relationships.

»GLOBAL EXPERIENCE. The Company’s products are marketed in approximately 200 countries and territories, reflecting the global nature of its business. In fiscal year 2013, approximately 26% of the Company’s revenues came from outside the U.S. and more than 98% of the Company’s products were sourced from outside the U.S. Directors familiar with the challenges and opportunities faced by a global business add value to the Board.

»FINANCE EXPERIENCE. The Company uses financial metrics in managing its overall operations and the operations of its business units. The Company and its stockholders value accurate and insightful financial tracking and reporting. The Board seeks directors that understand finance and financial reporting processes, including directors who qualify as audit committee financial experts. Experience as members of audit committees of other boards of directors also gives directors insight into best audit committee practices.

»PUBLIC AND PRIVATE COMPANY EXPERIENCE. The Company has been listed on the NYSE since 1965. Although the Company’s brand leaders operate as part of a public company, management expects them to drive growth in their business units using the entrepreneurial spirit of private company leadership. The Board believes it is important to have directors who are familiar with the regulatory requirements and environment for publicly traded companies, and to have directors who have experience applying an entrepreneurial focus to building a company or business unit.

|

2014 PROXY STATEMENT

»GOVERNMENT EXPERIENCE. A portion of the Company’s business involves government contracting, and the Company interacts with domestic and foreign governments routinely. The Board recognizes the importance of working constructively with governments around the world and believes it is helpful to have directors who have experience working in or with government.

shareholders. The Governance Committee also considers an individual’scandidates' relative skills, attributes, background and characteristics, their exemplification of the highest standards of personal and professional integrity,characteristics; independence under NYSEapplicable New York Stock Exchange ("NYSE") listing standards and the Company’sCompany's Director Independence Standards,Standards; potential contributionto contribute to the composition and culture of the Board,Board; and ability and willingness to actively participate in the Board and committee meetings and to otherwise devote sufficient time to Board duties.

2017 PROXY STATEMENT

As part of an annual self-assessment, each director evaluates the performance of the Board, and any committee on which he or she serves, across a number of dimensions. Mr. Kollat, as the Lead Independent Director working with the Governance Committee, reviews the Board self-assessment with directors following the end of each fiscal year, and conducts individual director interviews at the end of each year. Committee Chairpersons review the committee self-assessments with their respective committee members and discuss them with the Board. In addition, the Governance Committee, working with the Lead Independent Director, develops and implements guidelines for evaluating all directors standing for nomination and re-election.

The Corporate Governance Guidelines (including the Director Independence Standards), the Charter for each Board standing committee (Audit, Compensation and Governance), the Company's Certificate of Incorporation, By-Laws, Code of Business Conduct, and its Accounting and Finance Code of Ethics all are available on the Wolverine Worldwide website at:http://www.wolverineworldwide.com/investor-relations/corporate-governance/

The Board and applicable committees annually review these and other key governance documents.

The Board oversees the Company's risk management and mitigation activities with a focus on the most significant risks facing the Company, including strategic, operational, financial, and legal compliance risks. This oversight is conducted through presentations by and discussions with the CEO, Chief Financial Officer ("CFO"), General Counsel, Chief Information Officer, brand and department leaders and other members of management. The Vice President of Internal Audit and Risk Compliance coordinates management's day-to-day risk management and mitigation efforts, and reports directly to the Audit Committee.

The Vice President of Internal Audit and Risk Compliance reviews with the Audit Committee periodically, and with the full Board annually, management's related assessment and mitigation strategies. In addition to the above processes, the Board has delegated risk management and mitigation oversight responsibilities to its standing committees, which meet regularly to review and discuss specific risk topics that align with their core responsibilities.

The Company reviewed its compensation policies and practices to assess whether they are reasonably likely to have a material adverse effect on the Company. As part of this review, the Company compiled information about the Company's incentive plans, including reviewing the Company's compensation philosophy, evaluating key incentive plan design features and reviewing historic payout levels and pay mix. With assistance from Company management and its independent compensation consultant, the Compensation Committee reviewed the executive compensation program, and managers from the Company's human resources and legal departments reviewed the non-executive compensation programs.

| | |

| | |

Page 16 | | | Wolverine Worldwide Notice of 2017 Annual Meeting of Shareholders and Proxy Statement |

2017 PROXY STATEMENT

CODE OF BUSINESS CONDUCT AND ACCOUNTING AND FINANCE CODE OF ETHICS

The Board has adopted a Code of Business Conduct for the Company's directors, officers and employees. The Board also has adopted an Accounting and Finance Code of Ethics ("Accounting and Finance Code") that focuses on the financial reporting process and applies to the Company's CEO, CFO and Corporate Controller.

The Company discloses amendments to or waivers from its Code of Business Conduct affecting directors or executive officers and amendments to or waivers from its Accounting and Finance Code on its website at:www.wolverineworldwide.com/investor-relations/corporate-governance/

SHAREHOLDER COMMUNICATIONS POLICY

Shareholders and other interested parties may send correspondence to the Board, the non-employee directors as a group, a specific Board committee or an individual director (including the Lead Director) in the manner described below.

The General Counsel will provide a summary and copies of all correspondence (other than solicitations for services, products or publications) as applicable at each regularly scheduled meeting.

Communications may be sent via email through various links on our website atwww.wolverineworldwide.com/investor-relations/corporate-governance/or by regular mail c/o Senior Vice President, General Counsel and Secretary, Wolverine World Wide, Inc., 9341 Courtland Drive, N.E., Rockford, Michigan 49351.

The General Counsel will alert individual directors if an item warrants a prompt response from the individual director prior to the next regularly scheduled meeting. Items warranting a prompt response, but not addressed to a specific director, will be routed to the applicable committee Chairperson.

| | |

| | |

Wolverine Worldwide Notice of 2017 Annual Meeting of Shareholders and Proxy Statement | | | Page 17 |

2017 PROXY STATEMENT

Proposal 1 – Election of |

Wolverine Worldwide’sThe Company's Board consists of 1211 directors. The Company’s Amended and Restated By-laws (the “By-laws”) divide the Board intoCompany's By-Laws establish three classes of directors, with each class being as nearly equal in number as possible. Each class serves apossible and serving three-year term of office.terms. At each annual meeting, the term of one class expires. The Company’s Corporate Governance Guidelines state that a director must retire and resign from the Board at the Annual Meeting of Stockholders following his or her 72nd birthday, subject to the Board waiving this requirement under exceptional circumstances. The Board has nominated four directors for election at the annual meeting to be held on April 23, 2014:Annual Meeting: William K. Gerber, Blake W. Krueger, Nicholas T. Long, and Michael A. Volkema. Each director ishas been nominated to serve for a three-year term expiring at the annual meeting of stockholdersshareholders to be held in 20172020 or until his or her successor, if any, has been elected and is qualified. Alberto L. Grimoldi and Shirley D. Peterson are both 72 years of age and are expected to retire as of the date of the Annual Meeting. Upon the Board’s acceptance of their respective offers to retire, the number of Directors will be reduced to reflect their retirement.

Messrs. Gerber, Long and Volkema are independent directors, as determined by the Board under the applicable rules for companies whose securities are traded on the New York Stock Exchange (“NYSE”)NYSE listing standards and the Company’sCompany's Director Independence Standards. Each director nominee currently serves on the Board and the stockholdersBoard. The shareholders elected Messrs. Gerber, Krueger, Long and Volkema at the Company’s 2010Company's 2014 annual meeting. Mr. Long was appointed to the Board in July 2011. meeting by affirmative vote of at least 98% of shares voted.

The Company is not aware of any nominee who will be unable to or will notunwilling to serve as a director. However, if a nominee is unable to serve or is otherwise unavailable for election, the incumbent directors may or may not select a substitute nominee. If the directors select a substitute nominee, the proxy holder will vote the shares represented by all valid proxies for the substitute nominee (unless you give other instructions)instructions are given).

The biographies of the four nominees and the other directors of the Company are printed below, along with a discussion of the above-describedexperience and skills and qualifications forof each director. Following the biographies is a chart that summarizes the skills and qualifications of the nominees and directors.

| | |

| | |

Page 18 | | | Wolverine Worldwide Notice of |

20142017 PROXY STATEMENT

Directors with Terms |

| | | | | | | |

WILLIAM K. GERBER | ||||||

| ||||||

| ||||||

| Select Business Experience: | Board Committees: | Other Public Directorships: |

Mr. Gerber is Managing Director of Cabrillo Point Capital LLC, a private investment fund. He has held that position since 2008. From 1998 to 2007, Mr. Gerber was Executive Vice President and Chief Financial Officer of Kelly Services, Inc., a publicly traded global staffing solutions company with operations in more than 35 countries. During the preceding five years, Mr. Gerber was, but no longer is, a director of Kaydon Corporation.

Career Highlights: | ||||||

|

| | |

| | |

Footwear, Apparel and Retail Experience – Served for 15 years in leadership positions with L Brands, Inc. (formerly Limited Brands, Inc.), a publicly traded multinational apparel and retail company, in addition to service as a director of the Company.

Leadership Experience – Served for 24 collective years in leadership roles for L Brands, Inc. and Kelly Services, Inc., both publicly traded companies, including as Chief Financial Officer of Kelly Services, Inc.

Global Experience – Served for 24 collective years as a senior executive for L Brands, Inc. and Kelly Services, Inc., both multinational companies, and service for more than five years as a director for the Company.

Finance Experience – Served for 10 years as Chief Financial Officer of Kelly Services, Inc. where he was responsible for investor relations, mergers and acquisitions and purchasing in addition to core Chief Financial Officer functions; and served for 15 years in various finance roles, including Vice President, Finance, and Vice President, Corporate Controller, for L Brands, Inc.

Public and Private Company Experience – Service as a director of AK Steel Holding Company, an integrated producer of flat-rolled carbon, stainless and electrical steels and tubular products, and Kaydon Corporation, a publicly traded company that designed and manufactured custom-engineered products, including 20 collective years of experience serving as a member of the audit committees of AK Steel Holding Corporation, Kaydon Corporation, and the Company, and experience as the chair of the audit committees of the Company, AK Steel Holding Corporation and Kaydon Corporation.

Wolverine Worldwide Notice of | | Page |

20142017 PROXY STATEMENT

| | | | | | | |

BLAKE W. KRUEGER | ||||||

| ||||||

| ||||||

| Select Business Experience: | Board Committees: |

Mr. Krueger is Chairman of Wolverine Worldwide, a position he assumed in January 2010, and Chief Executive Officer and President of Wolverine Worldwide, positions he assumed in April 2007. From October 2005 until April 2007, Mr. Krueger served as President and Chief Operating Officer of Wolverine World Wide, Inc. From 2004 to October 2005, he served as Executive Vice President and Secretary of Wolverine Worldwide and President of the Heritage Brands Group. From 2003 to 2004, Mr. Krueger served as Executive Vice President and Secretary of Wolverine Worldwide and President of the Company’s Caterpillar Footwear Group. He also previously served as Executive Vice President, General Counsel and Secretary of Wolverine Worldwide with various responsibilities including the human resources, retail, business development, accessory licensing, mergers and acquisitions, and legal areas.

Other Public Directorships: | ||||||

| ||||||

Experience and Skills: | ||||||

Leadership Experience – Service for more than 15 years in senior leadership roles with the Company with responsibilities for operational and staff areas of the business, including brand, manufacturing and sourcing operations, and corporate governance, legal, human resources and mergers and acquisitions, and service for seven years as Chief Executive Officer.

Global Experience – Service for more than 15 years in senior leadership roles with the Company, including seven years as Chief Executive Officer with responsibility for international operations.

Public and Private Company Experience – Service for more than 15 years with the Company, including seven years as Chief Executive Officer and eight years as a director, and as a director of Bissell, Inc., a privately held vacuum cleaner and floor care product manufacturing company; and served as a director of Professionals Direct, Inc., a then publicly traded insurance company.

| | |

| | |

Page 20 | | | Wolverine Worldwide Notice of |

20142017 PROXY STATEMENT

| | | | | | | |

NICHOLAS T. LONG | ||||||

| ||||||

|

| Board Committees: | Other Public Directorships: | |||

|

|

| |||||||

Mr. Long has been Chief Executive Officer of MillerCoors LLC (“MillerCoors”), a joint venture between two publicly traded beverage companies, since 2011. From 2008 to 2011, Mr. Long served as President and Chief Commercial Officer of MillerCoors. From 2007 to 2008, Mr. Long served as Chief Executive Officer of Miller Brewing Company, a beverage company, and he served as Chief Marketing Officer of Miller Brewing Company from 2005 to 2007. Prior to joining Miller Brewing Company, Mr. Long spent 17 years in various senior leadership positions at The Coca-Cola Company, a beverage company, including Vice President of Strategic Marketing Global Brands, Vice President Strategic Marketing Research and Trends, President of Coca-Cola’s Great Britain and Ireland Division and President of the Northwest Europe Division.

| ||||||

| | |

| | |

Leadership Experience – Service for more than 20 years as a senior executive in the beverage industry, including experience in senior leadership positions with The Coca-Cola Company and Miller Brewing Company and as Chief Executive Officer of MillerCoors LLC.

Global Experience – Served in senior leadership positions with multinational companies, including management responsibility for Northwest Europe while with The Coca-Cola Company, and as a member of the 12-person Executive Committee of SABMiller, a global brewer.

Public and Private Company Experience – Service as Chief Executive Officer of a joint venture formed by two publicly traded beverage companies, and served in senior leadership positions with The Coca-Cola Company, a multinational publicly traded company, and Miller Brewing Company, a domestic subsidiary of SABMiller plc, a multinational publicly traded company.

Wolverine Worldwide Notice of | | | Page |

20142017 PROXY STATEMENT

| | | | | | | |

MICHAEL A. VOLKEMA | ||||||

| ||||||

| ||||||

| Select Business Experience: | Board Committees:

| Other Public Directorships:

|

Mr. Volkema has been Chairman of Herman Miller, Inc., a publicly traded multinational furniture manufacturer, since 2000. Mr. Volkema became President and Chief Executive Officer of Herman Miller in 1995 and held those positions until 2003 and 2004, respectively. Mr. Volkema has more than 30 collective years of experience on public company boards, including 13 years as Chairman of the Board at Herman Miller, Inc., and including service on the compensation and audit committees of boards of publicly traded companies. Mr. Volkema also is a director at Milliken & Company, a privately held, innovation-based company serving textile, chemical, and floor covering markets.

| ||||||

Experience and Skills: | ||||||

Leadership Experience –Service for more than 20 years in senior leadership positions with Herman Miller, Inc., a publicly traded multinational company, including nine years as Chief Executive Officer and 13 years as Chairman.

Global Experience – Service for more than 20 years in senior leadership positions and as a director of Herman Miller, Inc., a publicly traded multinational company, in addition to experience as a director of the Company.

Public and Private Company Experience – Service for more than 30 collective years on public and private company boards, including as Chairman of the Board for 13 years at Herman Miller, Inc., a publicly traded corporation, service as a director of Milliken & Company, a privately held company, including nine collective years of experience serving on compensation committees and five collective years of experience serving on audit committees of boards of publicly traded companies.

BOARD RECOMMENDATION

The Board recommends that you vote “FOR”"FOR" the election of the above nominees for terms expiring in 2017.2020.

| | |

| | |

Page 22 | | | Wolverine Worldwide Notice of |

20142017 PROXY STATEMENT

Directors with Terms |

| | | | | | | | |

ROXANE DIVOL | 44 | ||||||

Select Business Experience: | |||||||

| Other Public Directorships: | |||||

| ||||||

| ||||||

|

|

Mr. Grimoldi has been Chairman of Grimoldi, S.A., a manufacturer and retailer of footwear and accessories, since 1986. Mr. Grimoldi also was a member of the Advisory Board of Ford Motor Company Argentina, a multinational automotive company; Vice Chairman of Banco Privado de Inversiones, S.A., an investment bank; and in Argentina, Undersecretary of Foreign Trade, Undersecretary of Economics and Labor, Secretary of Industry and a member of the board of the Central Bank of Argentina.

| ||

| | |

|

Footwear, Apparel and Retail Experience – Service for more than 25 years in the footwear and retail industries, including as Chairman of Grimoldi S.A.

Leadership Experience – Service for more than 25 years as Chairman of a publicly traded Argentinean company and service in senior leadership positions of the Argentine government including as Undersecretary of Foreign Trade, Undersecretary of Economics and Labor, Secretary of Industry.

Global Experience – Service for more than 25 years as Chairman of an Argentinean company, more than 19 years as director of the Company, and served as a member of the Advisory Board of Ford Motor Company Argentina, a multinational company.

Finance Experience – Service as a member of the Advisory Board of Ford Motor Company Argentina, a multinational company, Vice Chairman of an investment bank, Banco Privado de Inversiones, S.A., as well as leadership and finance experience from government service in Argentina as Undersecretary of Foreign Trade, Undersecretary of Economics and Labor, Secretary of Industry and a member of the board of the Central Bank of Argentina.

Public and Private Company Experience – Service as Chairman of Grimoldi S.A., a publicly traded company, for more than 25 years and as a director of the Company for more than 19 years.

Government Experience – Service as Argentina’s Undersecretary of Foreign Trade, Undersecretary of Economics and Labor, Secretary of Industry and a member of the board of the Central Bank of Argentina.

Wolverine Worldwide Notice of | | | Page |

20142017 PROXY STATEMENT

| | | | | | | |

JOSEPH R. GROMEK | ||||||

| ||||||

| ||||||

| Select Business Experience: | Board Committees:

(Chair) | Other Public Directorships:

|

From 2003 until his retirement in 2012, Mr. Gromek served as President, Chief Executive Officer and a director of The Warnaco Group, Inc., a publicly traded company. Mr. Gromek also served as Chief Executive Officer of Brooks Brothers, Inc. from 1995 until 2002. Mr. Gromek also is a director of Stanley M. Proctor Company and J. McLaughlin, both privately held companies. He is currently the Chairman of the Board of Tumi, Inc., a publicly traded company featuring the leading global brand of premium travel, business and lifestyle products and accessories.

| ||||||

Experience and Skills: | ||||||

Leadership Experience – Served in leadership positions at several companies, including as Chief Executive Officer at two apparel companies. Global Experience – Served as the Chief Executive Officer of two multinational companies, Brooks Brothers, Inc. and The Warnaco Group.

Public and Private Company Experience – Service as a director of three publicly traded companies, The Children’s Place Retail Store, Inc., a children’s clothing retail company, Tumi, Inc., a wholesaler and retailer of luxury travel, business and lifestyle accessories, and the Company; service as a director of Stanley M. Proctor Company, a privately held company; service as a director of J. McLaughlin, a privately held retail company; service as Chief Executive Officer of The Warnaco Group, Inc. and Brooks Brothers, Inc. and as Chairman of the Board of Tumi, Inc.

| | |

| | |

Page 24 | | | Wolverine Worldwide Notice of |

20142017 PROXY STATEMENT

| | | | | | | |

BRENDA J. LAUDERBACK

| ||||||

| Select Business Experience: | Board Committees: | Other Public Directorships: | |||

|

|

|

, a footwear wholesaler and distributor. She previously was the President of the Wholesale Division of U.S. Shoe Corporation, a footwear manufacturer and distributor, a position that included responsibility for offices in China, Italy and Spain, and she was a Vice President/General Merchandise Manager of Dayton Hudson Corporation (now Target Corporation), a retail company. During the preceding five years, Ms. Lauderback also was, but no longer is, a director of Big Lots, Inc., a retail company. | ||||||

a restaurant company, and Select Comfort Corporation, a bed manufacturer and retailer, and as a director of Wolverine Worldwide, she also has extensive experience with public company governance and related matters. | |||||||||

From 1995 until her retirement in 1998, Ms. Lauderback was President of the Wholesale and Retail Group of Nine West Group, Inc., a footwear wholesaler and distributor. She previously was the President of the Wholesale Division of U.S. Shoe Corporation, a footwear manufacturer and distributor, a position that included responsibility for offices in China, Italy and Spain, and was a Vice President/General Merchandise Manager of Dayton Hudson Corporation, a retailer (now Target Corporation). During the preceding five years, Ms. Lauderback also was, but no longer is, a director of Irwin Financial Corporation, a publicly traded bank holding company.

|

| |

Footwear, Apparel and Retail Experience – Served for more than 25 years in the retail industry and more than 20 years in the footwear, apparel, and accessories industry, including senior leadership positions with Nine West Group, Inc., U.S. Shoe Corporation and Dayton Hudson Corporation.

Leadership Experience – Served in senior leadership positions for two publicly traded companies and service for more than 50 collective years on publicly traded company boards, including Big Lots, Inc., a retail company, Denny’s Corporation, a restaurant company, and Select Comfort Corporation, a bed manufacturer and retailer, and as a director of the Company.

Public and Private Company Experience – Service for more than 50 collective years on publicly traded company boards, including 28 collective years of experience serving on audit committees and 31 collective years of experience serving on governance committees, and chair of three governance committees of boards of publicly traded companies.

| | |

Wolverine Worldwide Notice of | | | Page |

20142017 PROXY STATEMENT

|

|

|

|

|

From 1995 until her retirement in 2000, Ms. Peterson served as President of Hood College in Frederick, Maryland. Prior to serving as President of Hood College, Ms. Peterson also served as Commissioner of the Internal Revenue Service and Assistant Attorney General of the Tax Division for the U.S. Department of Justice, and had 20 years in private law practice as a tax attorney with the law firm Steptoe & Johnson LLP. During the preceding five years, Ms. Peterson also was, but no longer is, a director of Champion Enterprises, Inc., a factory-built modular home manufacturer.

|

Leadership Experience – Served as President of Hood College, as Commissioner of the Internal Revenue Service, and for 20 years in private law practice, including as a Partner of Steptoe & Johnson LLP.

Public and Private Company Experience – Service for more than 40 collective years on publicly traded company boards, including AK Steel Holding Corporation, an integrated producer of flat-rolled carbon, stainless and electrical steels and tubular products, and The Goodyear Tire & Rubber Company, a multinational developer, manufacturer, marketer and distributor of tires, rubber-related chemicals, and operator of commercial truck service and tire retreading centers and tire and auto service center outlets, and more than 30 collective years of experience serving on publicly traded company audit committees, more than 35 collective years of experience serving on publicly traded company governance committees, and an additional 13 years of experience serving on the governance committee of a mutual fund complex.

Government Experience – Served as Commissioner of the Internal Revenue Service and Assistant Attorney General of the Tax Division for the U.S. Department of Justice.

|

|

| | | | | | | |

JEFFREY M. BOROMISA

| ||||||

| Select Business Experience: | Board Committees: | Other Public Directorships: | |||

|

| ||||||

Experience and Skills: | |||||||

|

| |

Mr. Boromisa was Executive Vice President of Kellogg International, President of Latin America; Senior Vice President of Kellogg Company, a global food manufacturing company, and a member of Kellogg Company’s Global Leadership Team from 2004 through his retirement in May 2009. From 2007 until 2008, Mr. Boromisa served as Executive Vice President of Kellogg International, President of Asia Pacific and Senior Vice President of the Kellogg Company. From 2004 through 2006, he was Senior Vice President and Chief Financial Officer of Kellogg Company. In 2002, Mr. Boromisa was promoted to Senior Vice President, Corporate Controller and Chief Financial Officer of Kellogg International. Mr. Boromisa served as Vice President and Corporate Controller of Kellogg Company from November 1999 until 2002. In 1997, he was promoted to Vice President – Purchasing of Kellogg North America, and from 1981 to 1997, served Kellogg Company in various financial positions. Mr. Boromisa also is a director at Haworth International, Inc., a privately held, multinational, office furniture design and manufacturing company.

|

| |

Footwear, Apparel and Retail Experience – Service for more than seven years as a director of the Company.

Leadership Experience – Served in senior roles involving executive management, brand management, marketing and international operations, for more than 25 years at Kellogg Company, a publicly traded multinational company.

Global Experience – Served in senior leadership positions at Kellogg Company, responsible for Latin American and Asia Pacific operations.

Finance Experience – Served as Chief Financial Officer and in various other senior finance roles at Kellogg Company.

Public and Private Company Experience – Served in senior leadership roles at Kellogg Company, a publicly traded multinational company, and serves as a director of Haworth International, Inc., a privately held company.

Page 26 | | | Wolverine Worldwide Notice of |

|

20142017 PROXY STATEMENT

| | | | | | �� | |

GINA R. BOSWELL

| ||||||

| Select Business Experience: | Board Committees: | Other Public Directorships: | |||

|

| ||||||

Experience and Skills: | |||||||

|

| |

Since 2011, Ms. Boswell has been Executive Vice President, Personal Care for Unilever PLC / Unilever N.V., a global food, personal care, and household products company whose products are sold in more than 190 countries and include such well-known global brands as Dove, Lipton and Hellman’s. From 2008 to 2011, Ms. Boswell served as President, Global Brands, for The Alberto-Culver Company, a consumer goods company. Ms. Boswell has held numerous other senior leadership positions with other leading global companies, including Avon Products, Inc., Ford Motor Company, and Estee Lauder Companies, Inc.

|

| |

Leadership Experience – Served in numerous senior leadership positions with leading global companies including Unilever PLC / Unilever N.V., The Alberto-Culver Company, Avon Products, Inc., Ford Motor Company and Estee Lauder Companies, Inc.

Global Experience – Served in global leadership roles at The Alberto-Culver Company, Avon Products, Inc., Ford Motor Company and Estee Lauder Companies, Inc.

Finance Experience – Currently Chair of ManpowerGroup Inc.’s audit committee.

Public and Private Company Experience – Served in senior leadership roles at publicly traded companies, most recently at Unilever PLC / Unilever N.V. Service as a public company director with ManpowerGroup Inc. and Applebee’s International, Inc.

| Wolverine Worldwide Notice of | | | Page 27 |

20142017 PROXY STATEMENT

| | | | | | | |

DAVID T. KOLLAT

| ||||||

| Select Business Experience: | Board Role: | Other Public Directorships: | ||||

Career Highlights: |

, a company specializing in research and management consulting for retailers and consumer goods manufacturers, since 1987. In addition to his marketing and management experience as Chairman and President of 22, Inc., Mr. Kollat served for 11 years in senior leadership positions at L Brands, Inc. (formerly Limited Brands, Inc.), a publicly traded, multinational apparel and retail company, including as Executive Vice President, Marketing, President of Victoria's Secret Direct, and as a member of its executive committee. Mr. Kollat is Lead Independent Director of Wolverine Worldwide, a position he has held since 2007. Mr. Kollat has been a director of L Brands, Inc. since 1976 and a director of Select Comfort Corporation, a bed manufacturer and retailer, since 1994. During the preceding five years, Mr. Kollat was, but no longer is, a director of Big Lots, Inc., a publicly traded retail company. | ||||||

Experience and Skills: | |||||||

| | |

Mr. Kollat has been Chairman and President of 22, Inc., a company specializing in research and management consulting for retailers and consumer goods manufacturers, since 1987. In addition to his marketing and management experience as Chairman and President of 22, Inc., Mr. Kollat has 11 years of experience as Executive Vice President, Marketing, and a member of the executive committee of L Brands, Inc. (formerly Limited Brands, Inc.), a publicly traded multinational apparel and retail company, and three years at L Brands, Inc. as President of Victoria’s Secret Direct. In 2009 and again in 2012 prior to Mr. Kollat’s re-nomination as a director, the Board decided to waive the Company’s age 72 resignation requirement for Mr. Kollat, allowing him to serve additional terms ending in 2013 and 2016, respectively. Mr. Kollat is Lead Director of Wolverine Worldwide. Mr. Kollat has been a director of L Brands, Inc. since 1976 and a director of Select Comfort Corporation since 1994. During the preceding five years, Mr. Kollat was, but no longer is, a director of Big Lots, Inc., a publicly traded retail company.

|

| |

Footwear, Apparel and Retail Experience – Service for more than 20 years as a director of the Company, for more than 25 years as a consultant to retailers and consumer goods manufacturers, and continuing service as a director of L Brands, Inc.; and served for more than 11 years in senior leadership roles at L Brands, Inc.

Leadership Experience – Service as a director of two publicly traded companies, L Brands, Inc. and Select Comfort Corporation, in addition to service as a director of the Company, and served as a director of Big Lots, Inc. and served for more than 11 years in senior leadership roles at L Brands, Inc.

Finance Experience – Has 16 collective years serving on audit committees and 11 collective years serving on finance committees of publicly traded companies.

Public and Private Company Experience – Has more than 90 collective years serving on public company boards, including 16 years of experience on audit committees, 22 years of service on compensation committees, 12 years of service on governance committees and 11 years of service on finance committees.

Page 28 | | | Wolverine Worldwide Notice of |

|

20142017 PROXY STATEMENT

| | | | | | | |

TIMOTHY J. O'DONOVAN

| ||||||

| Select Business Experience: | Board Committees: | Other Public Directorships: | |||

|

| ||||||

Experience and Skills: | |||||||

|

| |

Mr. O’Donovan is a former Chairman of the Board of Wolverine Worldwide and served in that position from April 2005 through December 2009. In April 2007, Mr. O’Donovan retired as Chief Executive Officer of Wolverine Worldwide, a position that he held since April 2000. Mr. O’Donovan served Wolverine Worldwide as its Chief Executive Officer and President from April 2000 until April 2005, and as Chief Operating Officer and President from 1996 until April 2000. Prior to 1996, Mr. O’Donovan held various positions with the Company, including Executive Vice President of Wolverine Worldwide. During the preceding five years, Mr. O’Donovan was, but no longer is, a director of Kaydon Corporation.

|

| |

Footwear, Apparel and Retail Experience – Service for more than 40 years in various positions with the Company, including seven years as Chief Executive Officer with responsibilities for all aspects of the business, including brand leadership, apparel and accessories development, footwear wholesale, retail business development, international operations, mergers and acquisitions, manufacturing and sourcing; and two years of service as non-executive Chairman of the Board.

Leadership Experience – Service for more than 40 years in a variety of positions with the Company, including seven years as Chief Executive Officer.

Global Experience – Service for more than 40 years in a variety of positions at the Company, including seven years as Chief Executive Officer, with responsibility for all aspects of the business, including international operations.

Finance Experience – Service in various roles with the Company responsible for financial operations, including seven years as Chief Executive Officer, and service for seven years on the audit committee of a publicly traded company.

Public and Private Company Experience – Service for more than 30 collective years on the boards of the Company, SpartanNash Company, a publicly traded company in the food distribution industry, and Kaydon Corporation and as lead director of Kaydon Corporation and SpartanNash Company.

| Wolverine Worldwide Notice of | | | Page 29 |

20142017 PROXY STATEMENT

n indicates the director has that skill or qualification.

| ||

| ||

The Board oversees the Company’s risk management and mitigation activities directly through presentations by and discussions with the CEO, Chief Financial Officer (“CFO”), General Counsel, brand and department leaders, and other members of management. The Vice President of Internal Audit and Risk Compliance coordinates management’s day-to-day risk management and mitigation processes, and reports directly to the CFO and also reports directly to the Audit Committee. The Vice President of Internal Audit and Risk Compliance reviews with the Audit Committee quarterly and with the full Board annually management’s risk assessments and mitigation strategies for

|

2014 PROXY STATEMENT

significant risks. In addition to the above processes, the Board has delegated the following risk management and mitigation oversight responsibilities to its standing committees, which meet regularly to review and discuss risk topics and then report to the full Board: